Form 2290 : E-Filing Vs Paper Filing

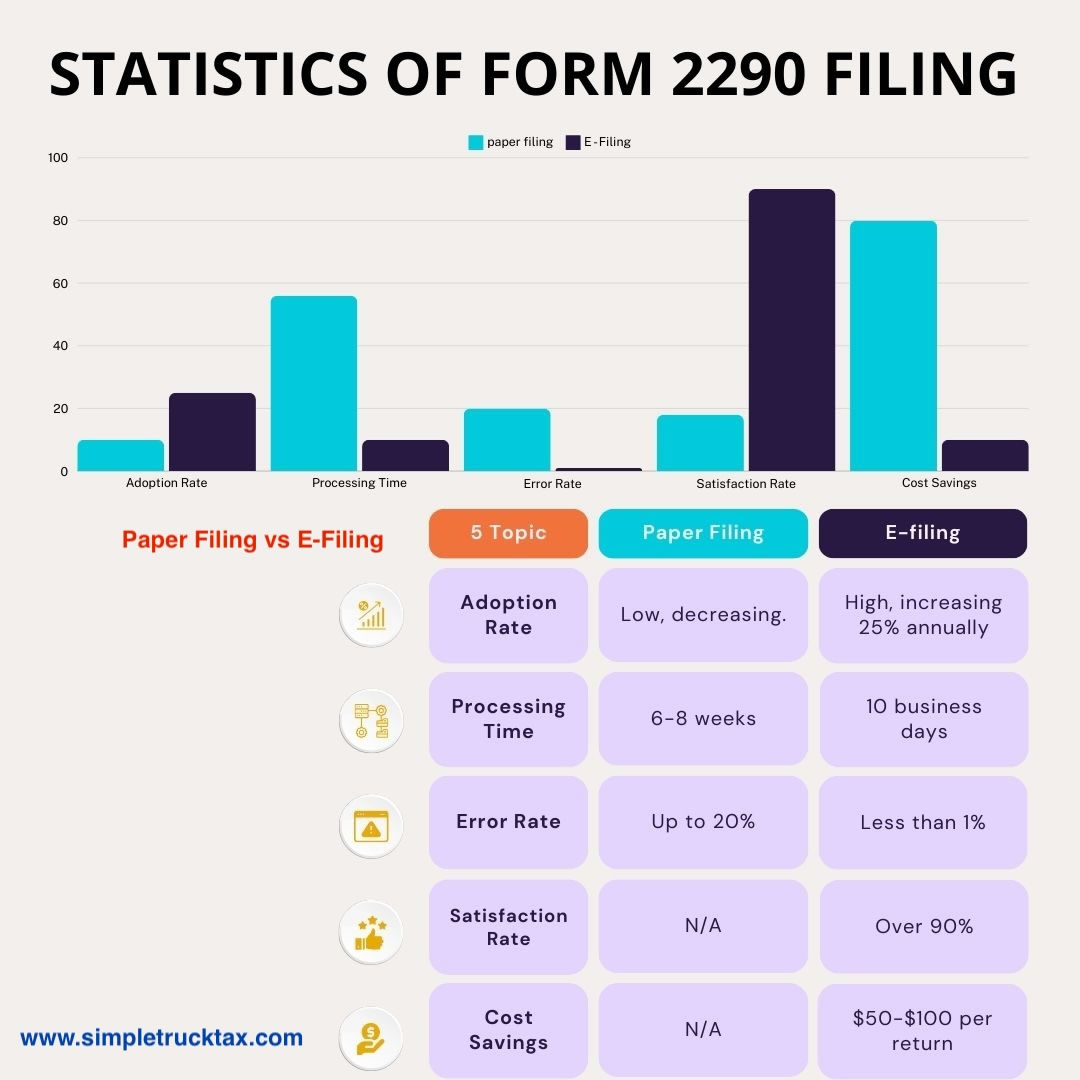

Adoption Rate:

Over the past five years, the adoption rate of e-filing for Form 2290 has increased by 25% annually.

Processing Time:

E-filed Form 2290 returns are processed by the IRS in an average of 10 business days, compared to 6-8 weeks for paper-filed returns.

Error Rate:

The error rate for e-filed Form 2290 returns is less than 1%, significantly lower than the error rate for paper-filed returns, which can be as high as 20%.

Satisfaction Rate:

Taxpayers who e-file their Form 2290 express a satisfaction rate of over 90% due to the convenience and efficiency of the process.

Cost Savings:

E-filing Form 2290 saves taxpayers an estimated $50-$100 per return in printing, postage, and mailing expenses compared to paper filing.

Note: For more information, visit IRS website